Algo Trading using Davidd-Tech Strategies

By Richard Reeves

william

Last Update 1 年前

Time delay opening trades

Important note : When the bot opens trades sometimes there is a few seconds delay - this can have a measurable effects on overall profits over time - so often what you see on the strategy backtester in trading view will have slightly higher profits than reality over time - worth bearing in mind.

Server connection issues

Be realistic about backtesting - often server issues will not place trades and glitches happen so I always take the profits from he backtester and assume they would be 15% less at least than what trading view says to manage your risk better.

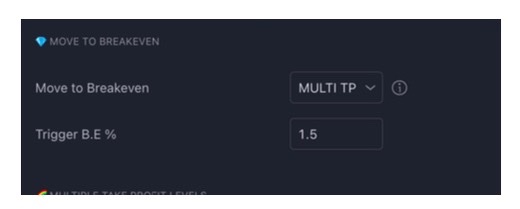

Multi TP - move to Break Even - This does nothing generally and other times messes up trades- just turn it off and save yourself hassle and defiantly have it off for backtesting.

Bybit testnet

Don’t bother use it - there is NO liquidity - its better to use a normal bybit account and stick a $100 dollars in and test using that.

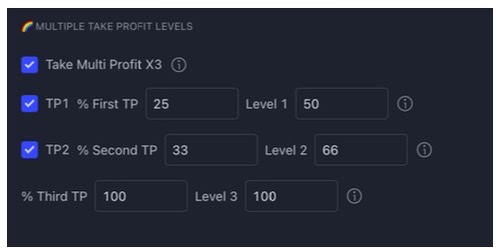

Multi TP Option

I manually backtested tested the Multi TP option on the strategy tester and the profits you see on the Strategy tester in TV are actually accurate (using bar magnifier) - apart from the time delay from opening trades on the bot which will show TV backtester trades as having a tiny bit more Profit and a tiny bit less loss than the reality on Bybit.

If u use David Tech Bot and IF your Strat is just one TP then tick Take Multi Profit X3 to ON, and turn off tp2 and set TP1 to 100% and 100% because u might have problems with Daviddbott setting ur TP other wise if u turn this off

Repainting

- learn about this and be aware - test your strategies over time to see if they repaint.

Please Read Davidd’s awesome document pdf with other important points if u have not already read it. “Getting Started - DaviddTech Guide”

The Cold Hard Truth about Algo trading using Trading View Strategy Tester

If you treat this as a way to make good and consistent money from the start then you most likely will be sadly disappointed, if however, you treat this as a fun hobby, and manage your risk correctly then you might just be able to make a little bit of money on the side.

As someone who grew up around professional traders in London, I have always known that markets are designed to take liquidity away from retail traders and give it to a very small% of professional trading firms.

Crypto is unregulated so it’s even easier for them to take your money, in fact - it is a trading firms dream as it is much easier for them to take money out the market and you will often see this through scam wicks on BTC and ETH.

Never use a strategy for long if it doesn’t look good for more than 6 months for it will almost certainly fail at some point. The best strategies are generally the ones that have worked for at least a year... but even they will fail eventually too. If you found a profitable strategy on Youtube from one of the most well known channels like ICT trader that’s is publicly available you can bet that it won’t be profitable for much longer.

BTC and ETH only started to be traded professionally with derivatives high volume and ETF’s towards the end of 2021 and so the price movement is very different from then.

Trading firms have back end access to the order flow behind the exchange and use this insider data to front run the rest of the market and take liquidity. Once retail traders figure out patterns in the market, the market makers will change the way they move the market based on liquidity in order to stay in constant profit.

Strategies are created by firms in Forex and Stocks, they then get figured out by retail after a few weeks/months before they become unprofitable. These starts then trickle down into crypto. Ten years ago it was pattern trading, then it became about support and resistance, and then they figured out smart money concepts.

This is why most strategies fail after a short time. If you don’t use more than 3x - 5x leverage depending on your account size - you might be able to survive long enough to see if a strategy really works. Its easy to look at the backtester and get excited by what you see - only to watch each on fail time and time again once you Strat trading them.

This is generally due to three reasons - one is that the trading firms change their strategy and move the price action in a different way.

The second is the limitations of Pinescript in Trading view, which sometimes can give a false idea of a strategy looking good - but upon manual backtesting you will see it does not always match up.

The third is overfitting - read about this and learn how best not to overfit your strategy settings, this is one of the main reasons algo trading from TV doesn’t work generally - we spend hours tweaking setting to fit historical price data - assuming the price will move like this in the future, only to find time and time again that it keeps evolving as the market figures out the firms strategies and the firms themselves switch to a new strategy.

For the most part - if you have made some good money on your account, it is best to take out most of the profits, before the strategy begins to fail and you start to loose your lovely new money.

Many people will show money shots using 20x -50x leverage making massive % gains and make it look easy to trade - but the reality is - very few people show their verified trading history as they are not consistently making money in the long term. Mostly those people are only trading with a couple of $100 in their account and also rarely show their losses. Unless you are scalping using the live DOM or using Orderflow to trade - it is actually very hard to be constantly profitable. But NOT impossible...

That said - one great thing about Algo trading - is that it takes away the emotional human element - if u can be disciplined and not use too much leverage and just let your strategy do its thing - you can make some good money before the strategy started to fail... IF you take profits out and actually deposit them in your bank as REALISED profits.

You will also probably have a number of issues along the way with the bot opening trades, unless you use something like Alertatron which is probably the most reliable, but slower, or decide to use your own server ideally in South East Asia for Bybit, it seems that most people find about about 30% of trades do not open correctly which can sometimes be easily corrected on the exchange, but sometimes can cause big losses - this is something to bare in mind when deciding on your risk and margin strategy. David Tech bot is constantly being worked on and so hopefully should become more reliable over time.

You are going up against massive firms which pump 100’s of thousands of dollars and sometimes millions into developing Quant strategies using machine learning - they generally only run their strategy for a few weeks if that before switching to something different - this changes the price action significantly over time and render many backtested strategies unprofitable.

Leverage

If you have 1000 dollars in your account and use 25x leverage then you are essentially trading with 25000 dollars.

If your stop loss is 1.5% away from entry that means after being stopped less than three times, having lost $375 each trade - you would have already liquidated your account.

When u enter and get stopped out - you are paying 0.14% fees on what you borrow - so with slippage you would be losing and extra $40 on top of your $375, so each loss is a total $415.

So with 25x leverage with a 1k account margin and just two looses you almost loose all your money - just remember that.

Very few traders can boast less than 4-5 losses in a row.

Unless you are a trading firm with the ability to manipulate the market yourself, then as a pro trader, you know that slow and steady wins the race.

A few years ago you needed a license to get 3x leverage. Now you can do 50x and its the way the exchanges take your money.

If you want to make real money - you need to use real money - not just a few hundred dollars. Using more than 5x leverage is the quickest way to say goodbye to your hard earned cash.

If you use 5x leverage with a 1k account margin then each loss is about $80

If you use 3x and are still in the game after a year then you are probably doing better than 95% of retail traders

Slow and steady wins the race.